CMO TLDR: AI, Netflix & Agency Earnings

Artificial Intelligence

Google Doubles Down on AI Content Creation Tools to Court Agencies

Google unveiled an expanded suite of generative AI content tools at Cloud Next, including Veo 2 for video, Imagen 3 for images, and Lyria for music, positioning itself beyond ad distribution to shape creative content production. Major brands like L'Oréal and Kraft Heinz are already implementing these tools, with L'Oréal producing 50,000 images and 500 videos monthly while Kraft reduced content production time from 8 weeks to 8 hours. By integrating with agency workflows and adding content safeguards like enhanced watermarking, Google aims to redefine the economics of creativity itself while addressing concerns around synthetic media.

Legal and Transparency Issues Hamper Marketer AI Adoption, WFA Finds

The World Federation of Advertisers reports that legal roadblocks, particularly around intellectual property and data protection, represent the primary challenge to scaling AI in marketing, with more than 700 people from 135 global brands joining the WFA's AI governance community to navigate these concerns. Brand executives are increasingly anxious about agency partners' use of AI and lack of transparency, though they're currently willing to pay a premium for agency AI expertise rather than seeking cost savings. Despite the challenges, 66% of brands surveyed are still in the early development stage of their AI strategies, with the most successful implementations being internal applications like media campaign reporting rather than consumer-facing initiatives.

WPP's 28,000 AI Agents Need Guardrails, Not Just Scale

WPP is pivoting from AI deployment to governance as the company's chief AI officer Daniel Hulme focuses on creating infrastructure to control its 28,000 AI agents already handling media planning, content generation, and analytics. Hulme is advancing "goal-directed adaptive systems" that evolve through experience rather than static code, with investments in neuromorphic computing and a research organization called Conscium that develops simulated environments to shape ethical agent behavior. With 65% of advertising executives rating generative AI as "very" or "extremely effective" according to William Blair's Q1 2025 survey, Hulme warns that untested autonomous agents could trigger industry-wide failures and subsequent regulation if they propagate flawed logic or misuse data.

Earnings Roundup

Publicis Reports Strong Q1 Despite Client Spending Caution on Tariff Uncertainty

Publicis Groupe posted 4.9% organic revenue growth and €3.5 billion ($4.6 billion) in net revenue for Q1 2025, driven by 12 significant client wins, including Coca-Cola's U.S. media account and Sam's Club, despite market challenges that saw its shares fall nearly 16%. CEO Arthur Sadoun warned that advertisers are adopting a "wait and see" attitude toward capital-intensive projects due to tariff uncertainty. However, the company invested €500 million in acquisitions, including data firm Lotame to strengthen its competitive position. Despite the macroeconomic headwinds, Publicis maintains its full-year guidance of 4-5% organic growth, positioning it to outperform rival WPP. However, it may soon lose its status as the world's largest ad holding company if Omnicom's proposed acquisition of IPG receives regulatory approval.

Omnicom Reports Modest Q1 Growth While Advancing IPG Acquisition

Omnicom Group posted 3.4% organic revenue growth to $3.7 billion in Q1 2025, slightly trimming its full-year guidance to 2.5-4.5% from 3.5-4.5% due to market volatility and tariff concerns. CEO John Wren reported the ad holding company has secured regulatory approval for its IPG acquisition from five of 18 jurisdictions—including China—while dismissing competitor claims that the merger would result in client or talent losses as "nonsense fed to trade publications." Despite economic headwinds from tariffs, Omnicom executives noted clients haven't yet adjusted their ad spending but are "looking for clarity" as they navigate the uncertain landscape.

Netflix Ad Tech Platform Debuts as Q1 Revenue, Profit Exceed Expectations

Netflix reports Q1 revenue and operating income grew 13% and 27% year-over-year respectively to $10.5 billion and $3.3 billion, exceeding guidance due to higher subscription and ad revenue. The streaming giant successfully launched its in-house "Netflix Ads Suite" platform in the US on April 1 and remains on track to roll it out globally in the coming months, with programmatic ad capabilities now available in UCAN, EMEA, and LATAM regions as part of its strategy to roughly double ad revenue in 2025.

Charts of the Week

Temu Abruptly Exits US Google Shopping Ad Market Amid Tariff Pressure

Chinese e-commerce giant Temu completely shut off its Google Shopping ads in the U.S. on April 9, causing its App Store ranking to plummet from a top-five position to 58th in just three days, revealing the company's heavy dependence on advertising for customer acquisition. The sudden advertising pullback coincides with the Trump administration's increased tariffs on Chinese imports to 125%, undermining Temu's direct-from-manufacturer business model and potentially providing temporary cost relief for competing advertisers in digital auction platforms.

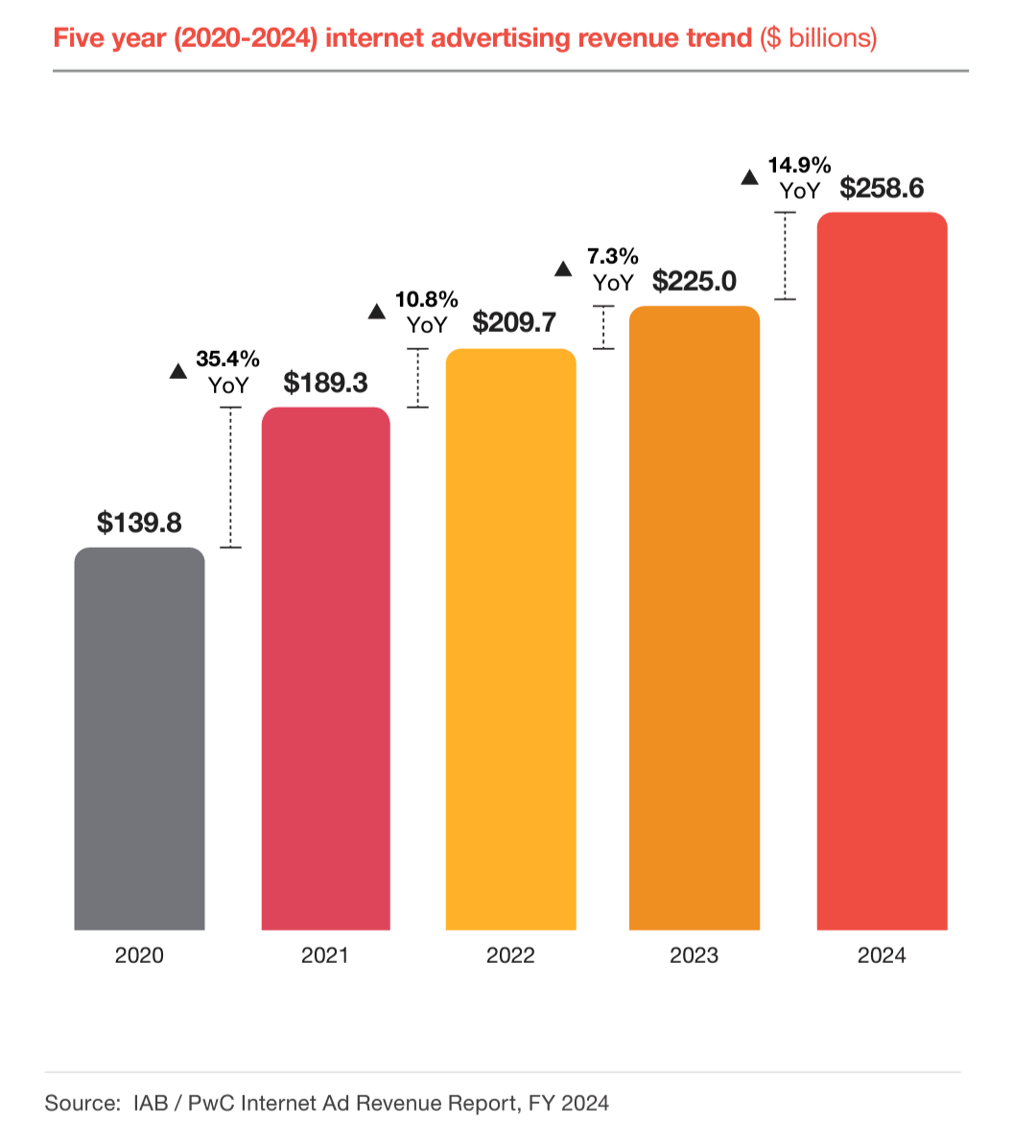

Digital Ad Market Hits Record High, Eyes AI-Driven Future

US digital ad spending soared 15% to a record $259 billion in 2024, fueled by robust growth across search, video, and a sharp rebound in social media. Digital video led the charge with 19% gains, while retail media networks surged 23% and podcasting jumped 26%, underscoring shifts in consumer habits and privacy adaptation. Industry leaders eye further transformation driven by AI integration, first-party data strategies, and the rise of seamless, commerce-led consumer experiences across fragmented streaming and creator landscapes.

Note: There is a lot to this report; this is just a top-level summary.

Quick Links

A federal judge ruled Google violated antitrust laws by monopolizing publisher ad servers and ad exchanges while illegally tying its ad server to its exchange, though the company escaped liability in the advertiser ad network market. The case now enters a remedies phase where the Department of Justice is pushing for divestiture of Google's ad tech business, potentially forcing a major restructuring of digital advertising's dominant player despite concerns that breaking up the company's tightly integrated ecosystem could harm publisher revenues.

AMC Networks and other major TV and streaming companies are increasingly deploying outcome-based measurement systems with real-time tracking capabilities that connect ad exposures to concrete business results like sales lifts and store visits, partnering with firms including LiveRamp, Nielsen Catalina Solutions, and Snowflake. While executives acknowledge the risks inherent in basing entire revenue models on direct consumer actions, some are cautiously exploring outcome-based pricing models for specific advertiser categories, potentially signaling a significant shift in how TV advertising is bought and sold.

Tommy co-founder Chris Edwards warns that brands pursuing high-volume, trend-chasing social media content risk eroding their distinctiveness and long-term equity, with 59% of British consumers already reporting there's "too much" advertising on social platforms. While platforms like TikTok reward frequency with its 30 million daily posts, Edwards argues successful brands like Duolingo and Ryanair maintain consistent, recognizable identities across formats rather than sacrificing strategy for speed or algorithmic engagement.

DoubleVerify has threatened legal action against adtech watchdog Check My Ads for alleged "defamatory statements" related to Adalytics research reports claiming verification vendors fail to detect bot traffic despite being paid to prevent ad fraud. The nonprofit organization responded that the legal demand makes "vague accusations" while seeking "sweeping preservation" of communications, arguing the request "raises serious concerns under well-established constitutional protections" and reinforces "the need for greater transparency and accountability in the digital advertising ecosystem.”

Brands including Mars, Diageo, and Beiersdorf are adopting AI tools from companies like CreativeX to ensure their digital ads meet established performance standards, with Kantar research showing creative quality contributes nearly 50% of media impact, outranking both reach and frequency control. Mars has increased the percentage of ads meeting their brand guidelines from below 30% to 80% in some markets through AI systems that automatically flag non-compliant elements, resulting in a 33% sales lift for optimized TikTok ads while saving "millions" in previously wasted media spend as companies navigate pressures from rising commodity costs and tariff uncertainty.

Key Article Takeaways - TLDR

Prioritize investments in AI-powered creative optimization tools, as creative quality drives nearly 50% of media impact, making it the highest-leverage opportunity for efficiency gains amid tariff-related budget constraints.

Develop contingency planning for Q3-Q4 media commitments, with holding company executives signaling clients are poised to adjust spending once tariff impacts become clearer, potentially creating both pricing volatility and strategic opportunities.

Accelerate the adoption of outcome-based measurement capabilities with TV and streaming partners, as early movers are already connecting ad exposures to sales lifts and store visits, and early movers have a significant advantage as CMOs will have their budgets scrutinized by CEOs and CFOs during times of market uncertainty.