CMO TLDR: Google’s future & earnings, and CTV Reach

Earnings

Google Ad Revenue Surges 12% in Q1 as Search and YouTube Show Strong Growth

Alphabet reported a 12% year-over-year increase in revenue to $90.2 billion for Q1 2025, with Google advertising revenue climbing to $66.9 billion, driven by robust growth in Search and YouTube ads, while Google's subscription business reached a milestone of 270 million paid subscriptions. Google Cloud revenue jumped 28% to $12.3 billion, bolstered by increased demand for its AI infrastructure and generative AI solutions, with CEO Sundar Pichai highlighting the company's "unique full stack approach to AI" as the foundation for growth across the business.

Google Abandons Chrome Cookie Choice Prompt, Maintaining Status Quo for Third-Party Tracking

Google has scrapped plans to implement a user choice mechanism for third-party cookies in Chrome. VP of Privacy Sandbox Anthony Chavez announced Tuesday that the company will "maintain our current approach" rather than rolling out a standalone prompt. The reversal effectively returns the ad industry to its pre-2019 state regarding cookie tracking, with Google citing "divergent perspectives" from stakeholders and changing regulatory landscape as factors in the decision. While Google still plans to enhance Incognito mode protections with IP Protection in Q3 and continue some Privacy Sandbox initiatives, the announcement leaves questions about the future direction of these technologies, with Chavez promising to share "an updated roadmap for these technologies" in the coming months.

Breaking Up Google Won't Necessarily Boost Publisher Revenue, Industry Expert Argues

In a pointed analysis published today, advertising expert Paul Bannister argues that while Google's antitrust loss could create a more competitive adtech ecosystem, the remedies alone won't guarantee improved publisher economics. Bannister outlines a hypothetical scenario where Google divests Google Ad Manager and AdX while maintaining programmatic demand flows, suggesting this would modestly help publishers but wouldn't necessarily reduce overall adtech fees in a market where competitors already charge similarly high rates. The more crucial question, according to Bannister, is whether these changes would make web advertising more attractive to advertisers overall, potentially requiring companies like The Trade Desk to take stronger positions on market transparency once "Google [is] no longer the proverbial 800-pound gorilla.”

CTV: LG's Home Screen Play vs. Industry's Reach Gap

LG Bets CTV Future on Home Screen Dominance

LG Ad Solutions is betting its advertising future on the smart TV home screen, positioning it as the new "first ad in break" by making it the central gateway for viewers' content discovery across streaming platforms. Chief Revenue Officer Ed Wale projects "record revenues" this year as the company leverages its footprint of approximately 200 million TVs globally while expanding its WebOS operating system beyond televisions into car monitors and hotel screens. The strategy hinges on LG's ability to track viewing habits across all apps and platforms, creating a recommendation engine that drives increased overall viewing while monetizing every moment of audience attention across an expanding network of screens.

CTV Ad Campaigns Reach Only 20% of Potential Audience, Innovid Report Shows

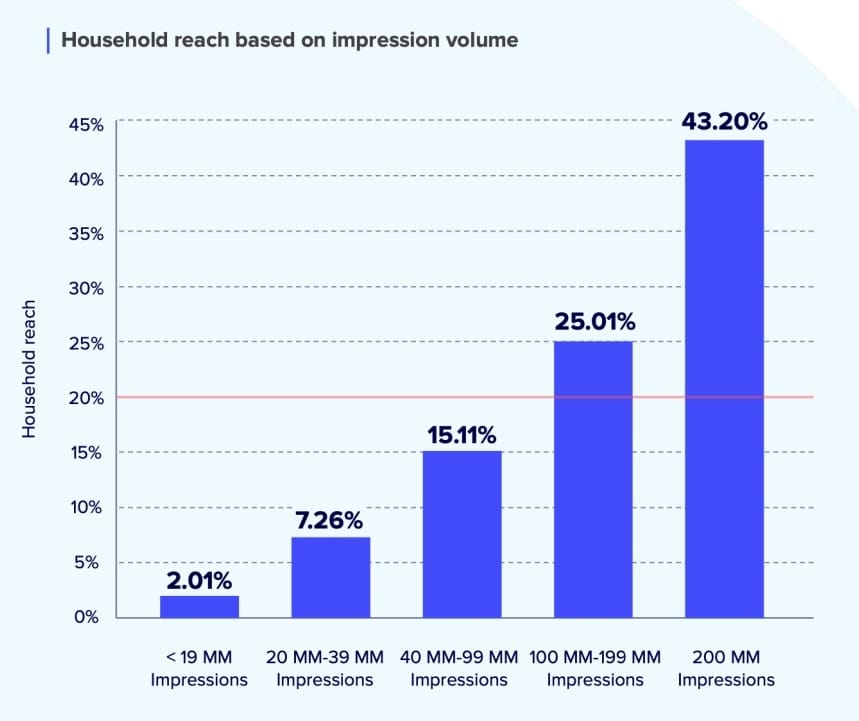

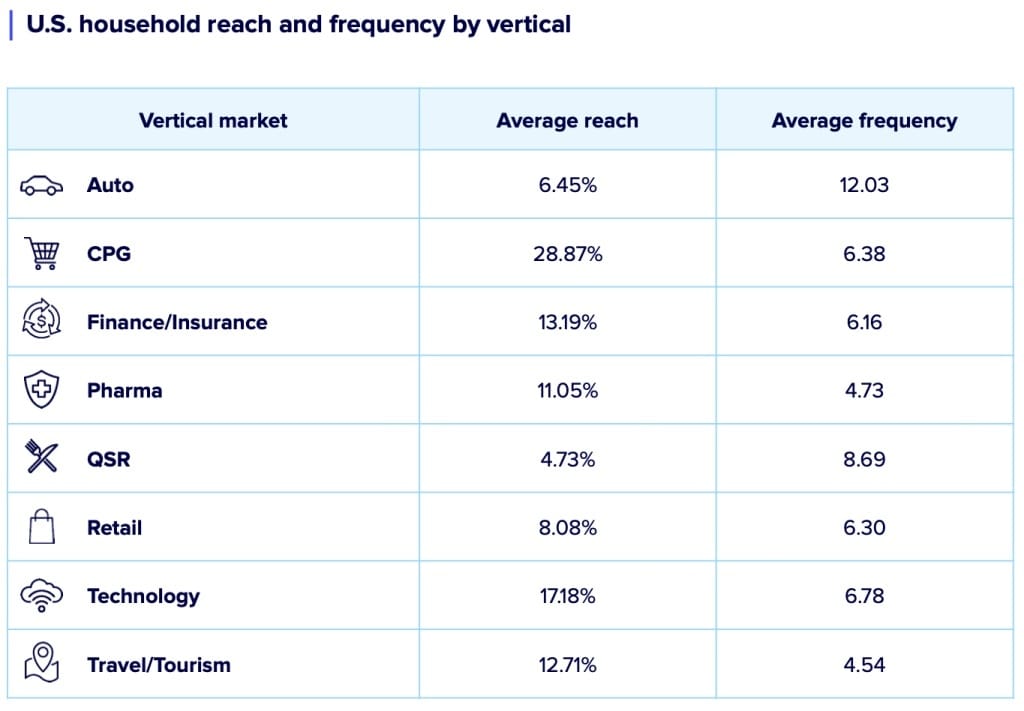

Connected TV advertisers are facing a significant reach challenge, with the average campaign reaching just 19.6% of available households while serving ads 7.09 times per household in 2024, according to a new report from Innovid being published today. The data, which spans 95 million U.S. households, reveals an imbalance between reach and frequency that varies by category, with auto advertisers recording the highest frequency but second-lowest reach despite typically targeting broad sports programming audiences. Agency executives interviewed emphasize the ongoing struggle to "maximize reach against the right audiences while mitigating excessive frequency," highlighting the industry's continued reliance on these fundamental metrics even as business outcome measurement gains attention ahead of upfront negotiations.

Quick Links

Amazon's advertising business is seeing significant growth amid economic uncertainty, with data showing its Sponsored Products ads rose 9% year-on-year in Q1 2025 and DSP spending jumped 25.4% as brands seek performance-driven channels. Marketing executives attribute the shift to Amazon's e-commerce data and performance tools becoming "a strategic choice for brands looking to drive efficient growth" during a period of tariff concerns and declining consumer confidence.

Private equity firm MidOcean Partners has acquired GSTV, the largest video ad network on gas pump screens valued between $500-600 million, as retail media M&A activity accelerates amid projections that retail media ad spend will reach $62 billion this year.

Meta is aggressively pursuing retail media budgets by enhancing data sharing capabilities and launching new tools, including an API that helps marketers track sales attribution and AI-powered carousel ads that optimize for both e-commerce and in-store purchases. The tech giant's push comes amid forecasts that retail media spending will reach $62 billion this year and growing competition from other platforms, with Meta's retail and e-commerce group lead Karin Tracy stating, "With retail media networks, we're here to be their partner.”

Dentsu has streamlined Merkle's operations by focusing the formerly sprawling data firm on just three core areas—CRM and loyalty, content and commerce, and data and analytics—repositioning it to compete more directly with consultancies like Publicis' Sapient and Accenture while moving its performance media capabilities into iProspect and creative functions into Dentsu Creative.

Magnite announced Wednesday it's merging its Magnite Streaming ad exchange with SpringServe, its ad server and mediation platform, into a unified product slated for full release by midsummer after beta testing with major CTV clients including Disney, Roku, Paramount, and Warner Bros. Discovery. The consolidation aims to create a "more efficient supply chain" for CTV buyers and sellers by combining previously separate technologies into a single interface with integrated programmatic capabilities and inventory sharing tools, according to Magnite's President of Revenue Sean Buckley.

Comcast reported mixed Q1 2025 results Thursday with overall revenue declining 0.6% to $29.9 billion, but streaming service Peacock emerged as a bright spot with subscriber count jumping to 41 million and revenue increasing 16% year-over-year to $1.2 billion, bolstered by the integration of its ad-supported tier into Charter's Spectrum TV Select bundle and increased subscription rates.

Key Article Takeaways - TLDR

Diversify your ad tech partnerships beyond Google's ecosystem. With Google abandoning its planned cookie choice prompt and potential antitrust remedies on the horizon, advertisers should begin exploring and testing alternative ad tech providers and measurement solutions. This preparation will be valuable whether Google eventually divests parts of its ad tech stack or simply continues its current approach.

Re-evaluate CTV targeting strategies to prioritize reach over frequency. The Innovid report shows that CTV campaigns reach only 19.6% of available households, while serving ads 7+ times per household highlights a significant opportunity gap. Marketers should audit their current CTV approach and consider implementing frequency caps while expanding audience targeting parameters.

Capitalize on Amazon's growing ad ecosystem amid economic uncertainty. With Amazon's Sponsored Products ads growing 9% YoY and DSP spending up 25.4% in Q1, performance-driven marketers should consider shifting more budget to Amazon's platform, particularly if consumer confidence continues declining due to tariff concerns and economic headwinds.