CMO TLDR: Amazon-Netflix Deal Hits TTD, Brands Ditch Cookies, Streaming Growth Slows

Collateral Damage

Netflix Hooks Up With Amazon's Ad Platform, Hitting Trade Desk Hard

Netflix announced a partnership with Amazon's demand-side platform that will let advertisers buy ads on the streaming service starting in Q4, dealing another blow to rival adtech company The Trade Desk. The move sent Trade Desk shares tumbling more than 10% Wednesday as Morgan Stanley analysts downgraded the stock, citing intensifying competition in connected TV advertising, where Amazon has been aggressively pursuing partnerships with major media companies. The Trade Desk's stock has now fallen by over 60% this year as Amazon enters deals that were once the exclusive domain of independent ad tech players.

Strategy Pivot

CPG Brands Ditch Cookies as Retail Media and Streaming Take Over

Consumer packaged goods companies are quietly abandoning third-party cookies as they pour more money into retail media networks like Amazon and Walmart's advertising platforms, which offer direct access to purchase data. The shift is being accelerated by surging investment in connected TV advertising, where nearly two-thirds of North American marketers plan to increase spending this year, according to Nielsen. While Google's decision to keep cookies alive removed the urgency, CPG brands are finding that retail media's precise targeting and streaming's premium reach deliver better results than traditional cookie-based digital advertising.

Expedia Builds Creative Agency to Turn Instagram Reels Into Bookable Trips

Expedia is testing technology that lets users forward Instagram Reels directly to its platform, where AI recreates the itinerary and makes it bookable in a bid to collapse the time between travel inspiration and actual booking. The travel giant has quietly built an in-house creative agency called Studio E to develop campaigns for brand partners, moving beyond traditional performance advertising as its media network division grows 19% quarterly. Expedia's strategy involves buying ads on other networks to drive traffic to its own ecosystem while leveraging data from 10 million weekly visitors to create what it calls the largest travel media network.

Charts of the Week

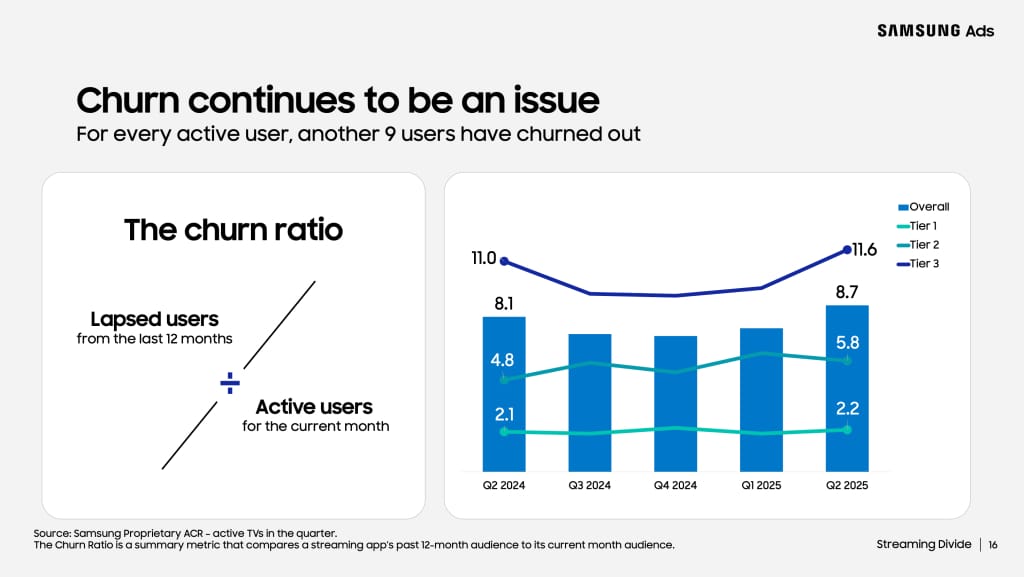

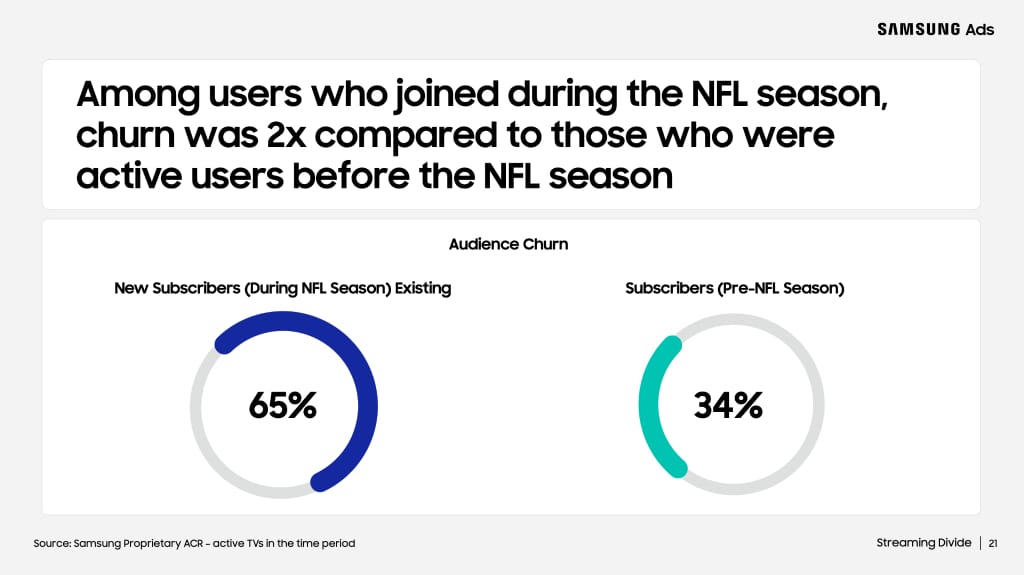

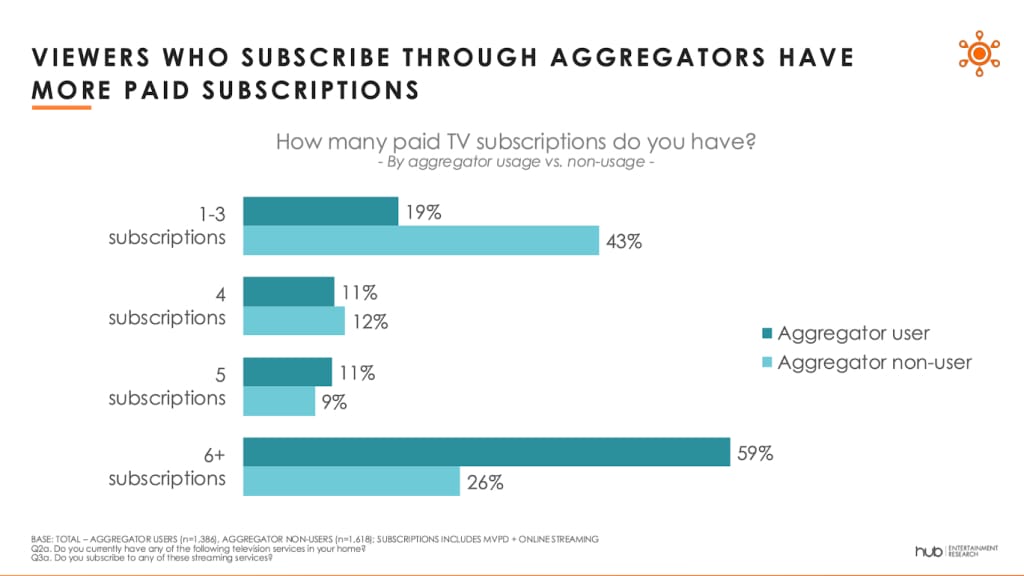

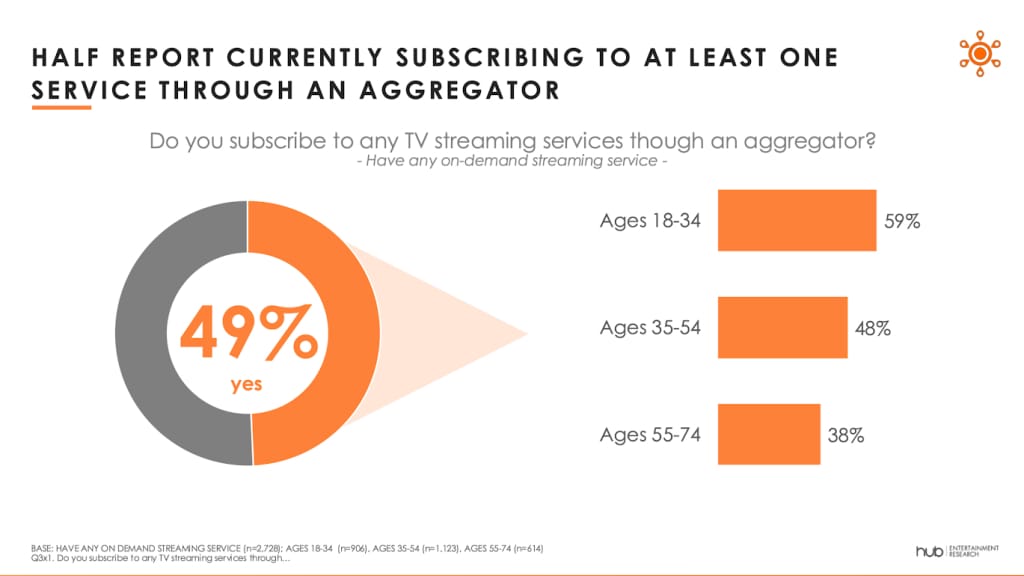

Streaming growth is slowing as churn edges higher, but aggregators are emerging as the preferred entry point for younger viewers who stack multiple services, a dynamic that boosts engagement yet intensifies volatility for niche and sports-driven platforms, particularly vulnerable during seasonal sign-up cycles.

Quick Links

The Trump administration is targeting direct-to-consumer pharmaceutical advertising through enhanced enforcement of existing regulations and plans to eliminate a 1997 provision that allowed drug companies to include only brief side effect disclosures in ads, a move that could fundamentally reshape the $39 billion pharmaceutical advertising market.

Raptive’s Chief Strategy Officer argues that while Transaction IDs help buyers eliminate wasteful bid duplication in programmatic advertising, some auction duplication actually benefits publishers by countering the market power of demand-side platforms that aggregate multiple advertisers into single bids, reducing competition and price discovery.

The Trade Desk has softened its approach to securing OpenPath deals with publishers, offering better financial terms and more flexibility after initially rigid contract negotiations, as the dominant demand-side platform faces intensifying competition from Amazon and other rivals for premium advertising inventory.

Google integrated Criteo as the first third-party retail media partner into its Search Ads 360 enterprise platform, allowing search advertisers to extend their campaigns into sponsored product listings across Criteo's network of more than 200 retailers without tapping separate retail media budgets.

Private equity firm Vitruvian Partners acquired a majority stake in healthcare advertising technology company DeepIntent for $637 million, with the funds earmarked for developing generative AI tools to enhance the platform that serves pharmaceutical giants including AstraZeneca, Bayer, and Johnson & Johnson.

Sports media company Minute Media acquired VideoVerse and its AI-powered Magnifi software to automatically create short-form video clips from longer sports content, aiming to boost ad revenue through personalized video experiences across its network of properties, including Sports Illustrated and The Players' Tribune.

Index Exchange CEO Andrew Casale criticized The Trade Desk's decision to reclassify all supply-side platforms as "resellers" under its Kokai buying platform, arguing the blanket categorization unfairly penalizes legitimate SSPs with direct publisher relationships while benefiting The Trade Desk's own curated supply paths.

Key Article Takeaways - TLDR

Netflix’s partnership with Amazon DSP underscores that Amazon is very much a competitor in streaming ads, contrary to The Trade Desk CEO Jeff Green’s past dismissal of them. Amazon’s DSP extends beyond Prime Video and, even if ads aren’t Amazon’s top strategic priority, the company is offering Wall Street tangible wins that are easier to measure than The Trade Desk’s platform upgrades with esoteric names. While the stock drop in TTD looks overblown, investor perception matters: strong share performance has historically bolstered The Trade Desk’s standing with clients, meaning it can’t afford to ignore the competitive narrative.